Make everyday things as teachable FQ moments

I am now a grandmother! If you follow me on my socials, you must have seen my posts of my precious granddaughter Amelia Isabel, the daughter of my second son Enrique and daughter-in law, Samantha. She is the first grandchild on both sides and so, both families are very excited. This made me go through the baby albums of my sons and consequently, it brought me wonderful memories of the 1990s when I was a young mother raising three boys together with my husband, Marvin.

For this week’s article, I wish to share with you how we brought them up, specifically on the financial aspect. Because FQ is a value system, it is really in the everyday things that we should use as teachable moments to raise them to develop this essential 21st century skill. Here are some of them.

1. Doing the grocery. When the boys were young they loved coming with me to the grocery. I’m not fond of doing the grocery and so it was only a once a month thing. Having them added spice to this rather mundane activity, but it also added challenge. The bill would be higher because of the items added by those little hands which were not in my list. To make this challenge more manageable, I tried to gamify it. When they started to learn how to read the price tags, I sometimes challenged them to pick things for their snacks given a certain budget. On top of that, we had guessing games on the total bill when we reached the cashier.

2. Buying a toy. Going to a big toy store was not only a delight for the boys but also for me. I also enjoyed looking at all the new items toymakers came up with. Because of the awe that both children and mother experienced inside a toy store, it was important for me to set parameters before entering the store. On occasions when were just supposed to buy a gift for someone, I would announce, “Today we will just buy a toy for your friend whose birthday is coming, okay?” This usually worked, but sometimes it was even the mom who would get excited over an educational toy and say, “This is so neat, let’s get it, you will learn something from this.”

In cases where the toy they wanted to buy was too expensive Marvin and I never said, “We don’t have money for that!” Why? Because even if this is the easiest way to end the discussion, it’s a lazy way to instill wise spending habits in your children. This is a teachable moment on opportunity cost! (As we discussed in FQ Book 2, it is what you have to give up to buy what you want.) Of course, I never used that geeky economic term to them but explained it in age-appropriate and relevant at the moment manner, “Don’t you think this is too expensive? With one of this you can already buy three different toys that will give you three different activities.” We were careful about the reason we gave because we didn’t want them to grow up thinking that it was always the having or not having the money that determines the purchase of something. We wanted them to have the control in deciding their purchases early on.

Giving a budget is also another way to teach them resource allocation.

3. Eating out. We love to eat out. We try new things together and we also have our usual go to restaurants. One of the things that we still do until now is to have a guessing game on the food bill. Early on, the boys learned that not ordering drinks and just having water cuts the food bill significantly without sacrificing their fill. This is not only good for the pocket but also good for everyone’s health as all the options on the menu are just sugary drinks.

4. Utility bills. We showed them our electricity, water, telephone and other bills. Once we started doing this, they became more conscious in turning off the faucets and appliances not in use. Moreover, they started learning how much it was to run a household.

5. Games to play. There was a time they loved playing board games like Monopoly and Millionaires. These are literally money lessons gamified! These days, more games that simulate business and economic activities are available in the market. Check them out and see what is suitable for your children.

6. Cellphone load. The boys received their first cellphones as gift from us, some time during their fifth grade. But we never gave them post-paid lines. We also made them pay for their own pre-paid loads. This turned out to be one of the best ways to teach budgeting skills. They came up with their own cost-benefit analyses in choosing which the best load option – unli-text, unli-call, etc.

7. Enrollment. When they reached the higher grades, I asked them to go through the motions of enrolling themselves. They would see all the cost components of going to school – from tuition to library fees, to textbooks, to uniforms and other materials. I was with them to either issue the check or sign forms. The exercise made them observe inflation, and most of all, it made them appreciate the privilege of going to their schools without worrying where the money would come from. In college, they were on their own – i.e. in the registration process, not the spending. This also made them appreciate the privilege of going to college without incurring student loans. Sometimes these privileges are not very salient to our children and parents may end up resenting their seeming ungratefulness. Simple exercises like this can make our children more aware of the cost of their education without the nagging comments from parents such as “Kaya kami naghihirap magtrabaho ay para makapag-aral ka lang! (We work so hard just for you to be able to study!). This will make them value their education more without the unnecessary drama.

8. Dinner Conversations. My favorite activity in the world is having dinner (or lunch) conversation with all family members. If there’s only one prescription that I can give to have a good family life, it is “Have regular meals and conversations with your family members.” It is in the regularity and openness of these conversations that you will get to know each others’ daily triumphs and struggles, and life aspirations. Include discussions about money – saving, investing in a pleasant way to avoid indigestion. Share with them how you went through financial struggles, the criteria you use in giving yourself a treat, etc.

These are just some of the ways we can turn every day and other regular activities into teachable moments. There are many more you can add to the list. Reflect on how you spend your typical day, your happy bonding time and see how you can incorporate your own teachable moments in them to raise your children to have a High FQ! Cheers!

ANNOUNCEMENTS:

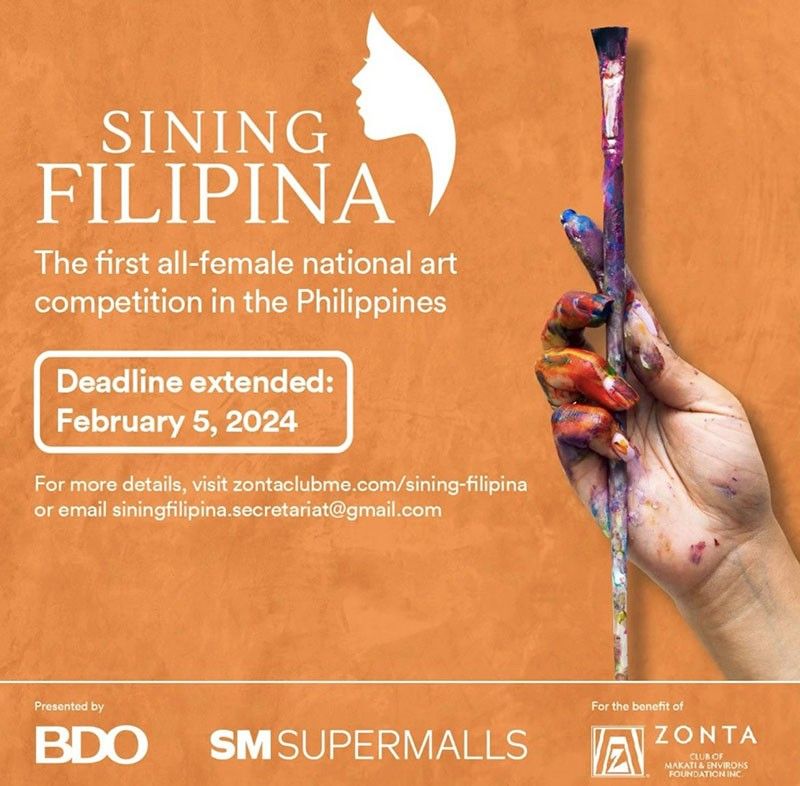

1. Join the first all-female national art competition in the Philippines extended until Feb. 5, 2024.

2. If you want to know where you are in your FQ journey. Click here.

3. If you want to know your FQ, buy our books. Click here.