What is the cost of YOLO-ing?

YOLO! You Only Live Once is a favorite excuse for our impulsive and reckless behavior. It is allowing our Emotional Emong to rule over our Makatwirang Mak in our choices today, making our present self happy at the expense of our future self.

The problem in the way we use “You only live once” is that it negates the ending of that one life we live. Let’s bear in mind that our one and only life has a beginning, middle part, and ending. And we are responsible for the outcome of that ending.

The younger generation has a more difficult time resisting YOLO. They want to experience all the good things in life right away. We used to also say “Carpe diem!” which means seize the day, to justify some of our reckless behaviors, but we were not as bombarded with the “inggit factor” as they are now, due to social media. During our time, we only compared ourselves with the people we physically interacted with. Moreover, traveling and buying stuff have never been this easy.

Let us look at the cost of YOLO-ing with the help of Makatwirang Mak and Emotional Emong from "FQ Book 2 Why Financial Education Alone in Not Enough" (back-to-back with The Psychology of Money).

Makatwirang Mak and Emotional Emong graduated in the same year. When they had their first jobs, they both started with the same salary. Mak started saving and investing right away. He paid himself first and did it regularly with a system. On the other hand, Emong said, “Oh, I’m still very young, I’ll chill and YOLO a bit.”

Emong’s “a bit” turned into a few years and later on, a decade. On his 10th anniversary from college graduation, he snapped out of his YOLO and finally remembered YAGO (You Also Grow Old). He decided to be serious about his investing and set aside exactly as much as Mak’s regular investment amount.

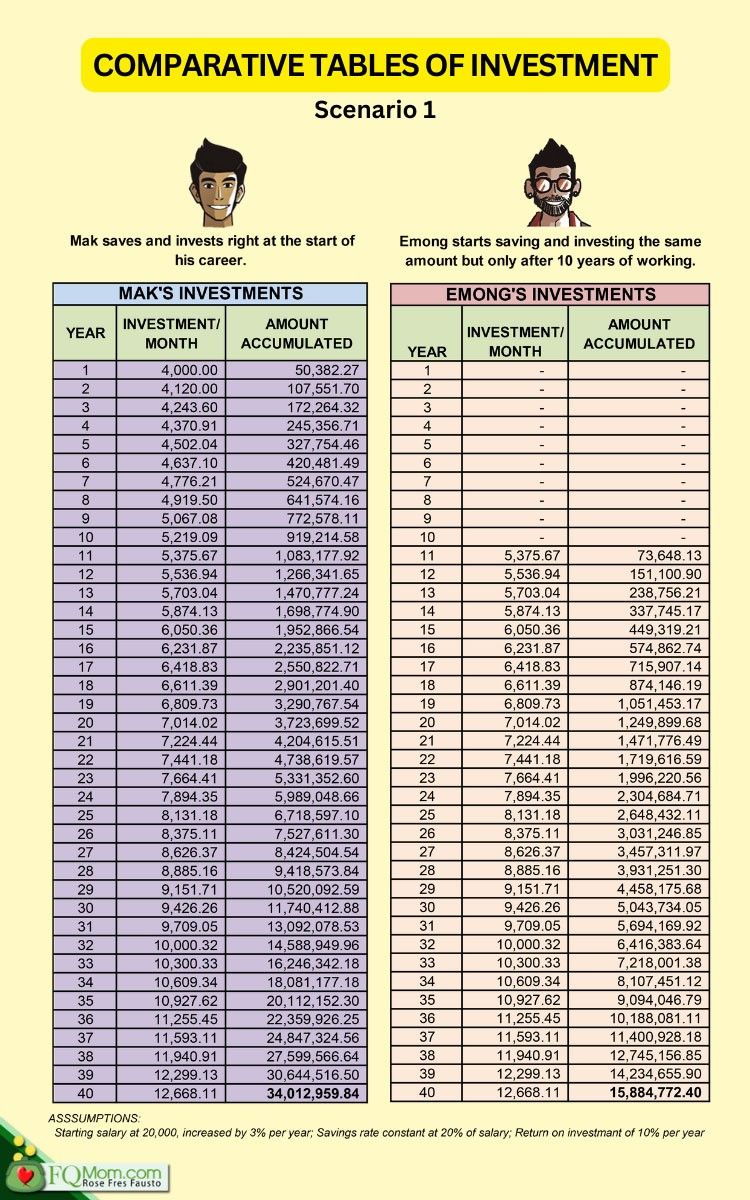

At the end of 40 years, right about their retirement, we can now see the results of their respective portfolios in the table below.

Mak accumulated P34.01 million in his retirement nest egg while Emong ended up with only P15.88 million. The cost of YOLO-ing for Emong is P18.13 million! That’s a big difference in their resulting standard of living come retirement years. Emong ended up with less than half of Mak’s retirement nest egg, even if he only chilled for 10 years or one-fourth of the investment period of 40 years. This is a powerful example of “You cannot turn back the hands of time!”

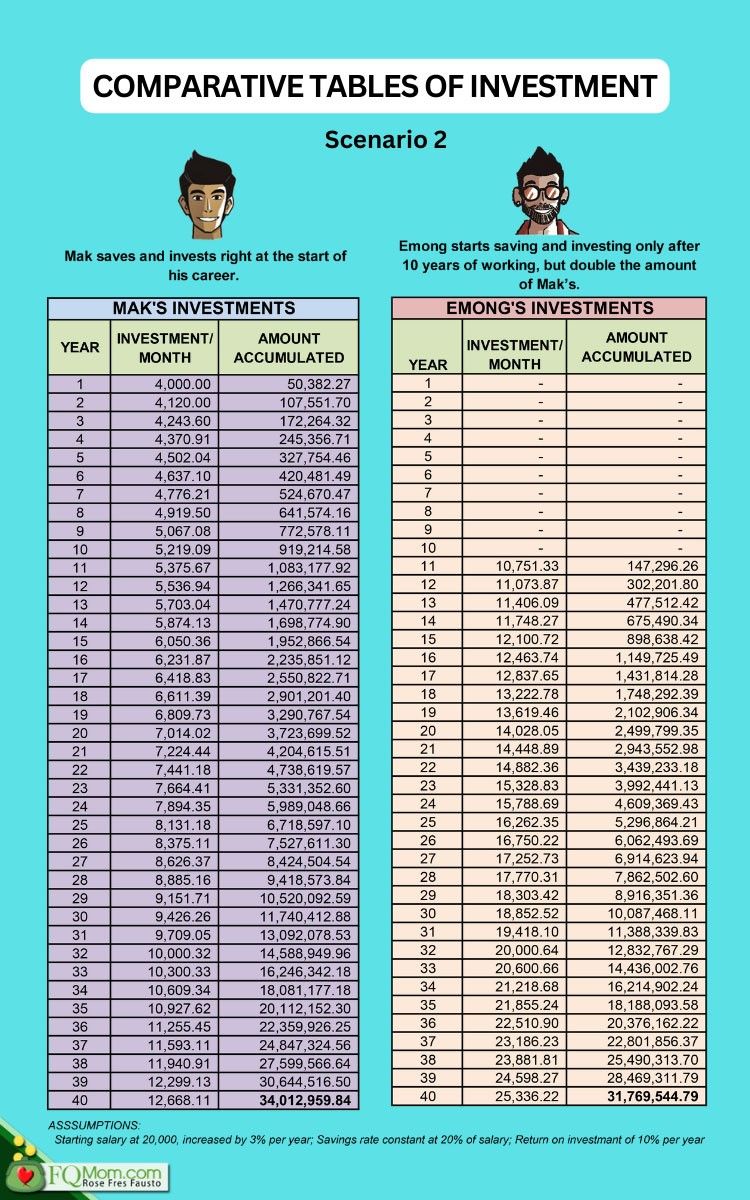

But let’s turn back the hands of time a bit. What if after 10 years of YOLO, Emong decides to save and invest more than Mak in order to catch up with or even surpass him? What if he invests double the amount of Mak’s regular investing? Will he end up with a larger nest egg? Will he be able to catch up? Let us see.

You may be surprised to see the result. Emong will end up with P31.77 million. Despite doubling his investment every month to catch up with Mak, he will still fall short of Mak’s P34.01 million. Despite Mak’s substantially lower monthly investment (only half of Emong’s), he will still end up richer at the end just because he remembered YAGO and ditched YOLO in his twenties.

Do you now see the cost of YOLO-ing?

Yes, we should enjoy our twenties but hey, don’t miss this important bus. Your twenties can still be enjoyed by starting your saving and investing right away. Put a system in place and never interrupt it unnecessarily. Heed this important advice from Charlie Munger when he was asked about the power of compounding.

Do you want to see your own numbers? What can happen to your retirement nest egg or any fund that you’re saving and investing for? If so, you may download the Magic of Compounding excel file for free at FQMom.com and input your own numbers to see where you’re headed to.

Good luck and if you follow Makatwirang Mak’s example and heed Munger’s advice, you will not incur the high cost of YOLO-ing and really live your one and only life to the fullest – both the present and the future. Cheers to High FQ!

ANNOUNCEMENTS:

1. Take the FQ test now to see where you are in your High FQ Journey.

2. Find out how much you can have when you retire by using the FQ Power of Compounding.

3. Thank you very much to all who came to The Little Vintage Shop last weekend. We continue to sell stuff through our IG account and accept donations. Please send us DM in the same account. To know where your donations and support to the shop go, please click this link.

4. Watch the short video of FausTour of the Happiest Countries in the World (Denmark, Iceland, Sweden, Netherlands).

This article is also published in FQMom.com.