Graduating during a crisis (To the Class of 2020)

I have been seeing graduation posts on social media since a couple of months ago. To the Class of 2020, my prayers are with you as you face enormous challenges. Unemployment, coupled with underemployment, has always been our country’s problem. This has encouraged many Filipinos, maybe some of them are your parents and loved ones, to seek greener pastures abroad resulting in the OFW phenomenon.

You now face extraordinary challenges. The economy is in lockdown. Aside from not having enough job opportunities for your batch, your own parents and other loved ones may be losing their jobs, and closing down businesses. You may be stuck at home with your family hearing news about higher COVID-19 cases, worn-out frontliners, declining economy, failure in leadership, increasing divisiveness, etc. All these may make you to fall into depression and apathy. All you have left are the inspiration you got from your commencement speakers delivered via zoom, the encouragement from your family and friends, and your internal drive to still claim your rightful place in this world. Please hold on to them.

Looking back

My husband graduated in 1983 when Ninoy Aquino was shot in cold blood on the tarmac of our international airport. To those who are too young to know or too lazy to check history, the Manila International Airport was named after Ninoy Aquino because his heroic act of returning to the country despite risks, warnings and threats, helped restore our democracy. Incidentally, last June, Rep. Paolo Duterte filed a bill with Congress to change the name from Ninoy Aquino International Airport (NAIA) to Paliparang Pandaigdig ng Pilipinas. This received flak from netizens, who rightfully complained about the priorities of our leaders during the time of pandemic. Some resorted to humor with comments like, “The English version may be better, it will be National Airport of the Philippines, NAP for short, very similar to how they handle the pandemic NAP as in No Action Plan!” “So, if It’s Paliparang Pandaigdig ng Pilipinas, shall we call it PaPaPi for short?” ![]()

The Aquino assassination in 1983 strengthened various movements to finally end the two decades of Marcos dictatorship. Jobs were difficult to come by. I personally knew some graduates who took positions where they were overqualified, just to get employed. I graduated in 1985 and was thankful to land my first job as an analyst shortly after graduating from college with the help of our university’s placement office.

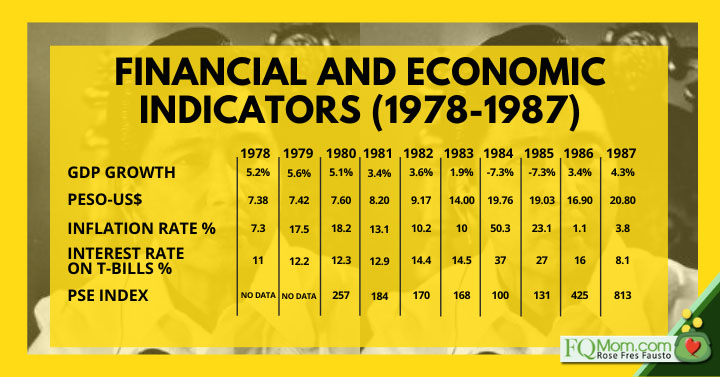

I write about this today to remind our 2020 graduates that there is hope even during the pandemic. I wish to share some economic indicators during our time, and later compare them with the said indicators during your time. (Share in twitter)

No matter what revisionists tell you about the Marcos era, economic data above should give you a more objective assessment. When you loot the economy, remove the checks and balances, abuse your power and your countrymen, the numbers will eventually catch up with you, no matter how much you massage them.

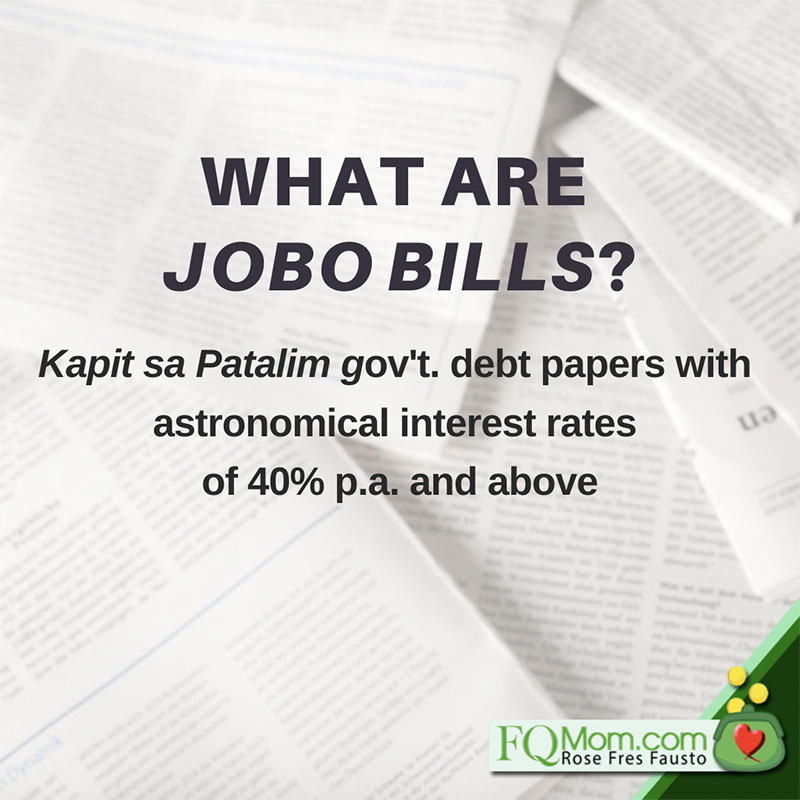

Incidentally, the above interest rates don’t include the Jobo bills that were 40% p.a. and above! What are Jobo bills? Here’s a dose of Philippine financial history. In 1983 after the Aquino assassination, our economy went from bad to worse, and the dictator was getting ill and sort of in a panic mode. The Philippine government could not meet the interest payments on our foreign currency debts. There was massive capital flight, we could not open Letters of Credit (that means nobody wanted to lend us anymore). The IMF (International Monetary Fund) gave us an emergency bailout with conditions to devalue our peso and tighten domestic credit. Then Central Bank Governor Jobo Fernandez was forced to issue what became known as Jobo bills, kapit sa patalim government debt papers that gave astronomical interest rates of 40% p.a. and above. Local banks bought these high-yielding papers, leaving very little left for private sector lending, consequently, leading to further economic downturn.

The foreign exchange rates above show a 158% peso depreciation from 1978 to 1985. And please take note, these were based on the official exchange rates. Once upon a time, we had the Binondo Central Bank, the black market for foreign exchange where the dollar was even more expensive. Moreover, check out our inflation rate: 50.3% in 1984! This reminded me of the stories of our grandparents about the Mickey Mouse money during the war when they brought “bayong-ful” of money just to go to the market to buy food.

After EDSA revolution, there was renewed confidence in the economy. Look at the PSE index, it rose by 224% from 1985 to 1986.

The recent past

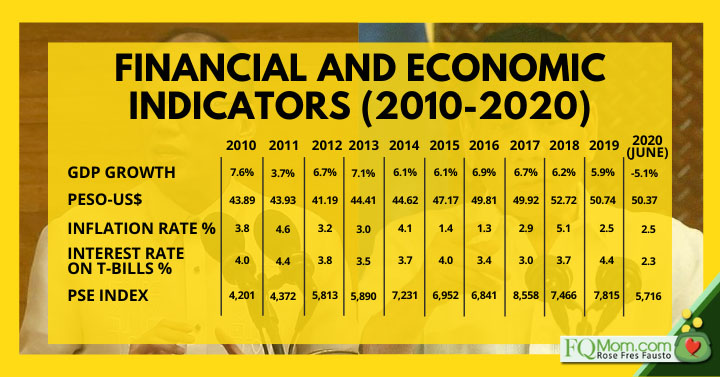

Let’s take a look at a similar table for your time.

As we continue to consume all the negative news and vibe surrounding us now, it’s difficult to rise above them all and see that we are still better off somehow in terms of economic indicators. It’s a good thing that during the previous regime we started recording healthy growth rates, among the highest in the region. We also received investment grade rating for the first time. Foreign exchange has been pretty much stable. Inflation and interest rates were single digits. PSEi has also increased from its 2010 levels, despite experiencing a lot of hiccups.

Even if our 2020 figures are expected to be dismal, we should remain steadfast.

Dear graduates, you still have a bright future. I’m glad to note that your generation is more entrepreneurial than our generation, an important characteristic given the times. Use that mindset to create new things, to improve our society, and add a dose of patience where it’s needed. Use your impatience on the things that are unacceptable in our society today. Remember, it takes long years to build an economy and restore democracy, but it only takes a few years to ruin everything. Learn from our mistakes. Remember that bad things happen when good men do nothing.

Of course, I will be remiss if I don’t mention that whatever stage our economy is in, we need to be prudent with the way we handle money. Always follow the three basic laws money: 1) Pay yourself first; 2) Get only into a business that you understand, and seek advice only from competent people; and 3) Make your gold work for you, make an army of golden slaves before you buy luxury. If you observe all these and do your duty as a citizen, you will look back to this crisis as your golden period of opportunity.

Cheers to high FQ!

***

ANNOUNCEMENTS

1. I’m going to have an online FQ Community get together. The FQMom Team will send invites to all subscribers. Subscribe and join us now!

2. Reading is another coping mechanism for the lockdown. If you haven’t yet, may I invite you to read any of the FQ Mom books?