Why are REIT stocks falling?

Thanks to Justine for the question. The quick answer is that REIT stocks are falling because the risk-free rate of return is rising, but let’s walk through it. So right off the top, REITs are kind of a different investment product from stocks, because their main selling point is access to a stable stream of income through dividends.

The price of the stock, then, rises and falls based on the demand for that stream of income. The better the stream of income, in terms of stability and growth potential, the more an investor would be willing to pay for it. This demand causes the stock price to rise, but the demand doesn’t do anything to the dividends; they’re the same regardless of the demand. So as the stock price increases relative to the dividend, the estimated yield decreases. But that makes sense, since you’re paying more for the same amount of income.

The inverse is also true: the worse the stream of income, the less an investor would be willing to pay for it, the lack of demand causes the stock price to drop, and the estimated yield rises relative to that declining stock price. Ok, so that’s a really high-level overview of REIT price dynamics.

But back to the question: why are the prices falling now? Well, it has to do with a lack of demand, and as we saw, a lack of demand causes prices to drop and yields to rise. Demand for REITs is dropping because interest rates are rising, and as interest rates rise, so do the yields of pretty much every fixed-income product. Government bills and bonds return higher yields. Corporate bonds and notes return higher yields. Treasury bills, which are nearly risk-free, went up from returning 1.36% in September 2021 to 3.38% in September 2022. The ability to earn a decent return at a lower risk-profile is thought to have increased the competition for the fixed-income investment money that was originally going into REITs in Q4/21 and Q1/22. So as those investors buy other products, or sell REITs to buy other products, the demand goes down for REIT shares, the prices of REIT stocks fall, and their yields rise.

MB BOTTOM-LINE

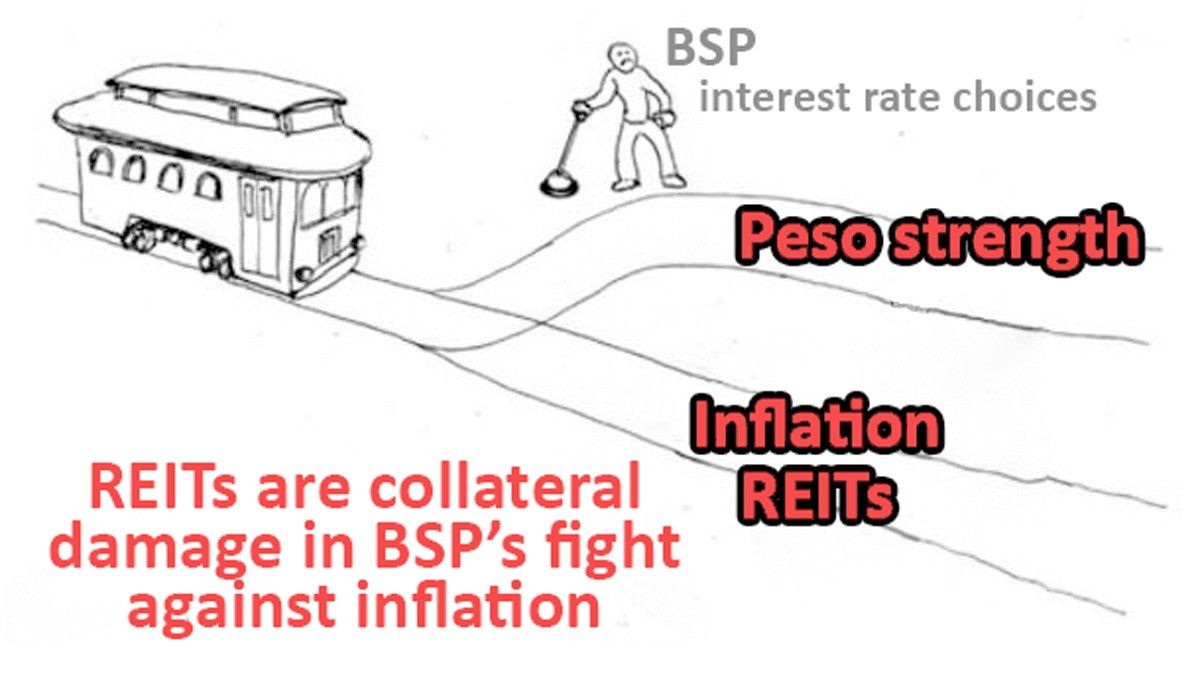

REITs are going to face selling pressure until the market gets a better idea of how high rates need to go in order to gain control of inflation.

We aren’t there yet.

If the BSP is still talking about back-to-back raises this November and December, this will further increase the return of those low-risk investment products like government debt and corporate debt, and push down prices of riskier returns like REITs.

Thankfully for REIT bagholders, the REIT companies that are still focused on growth while delivering a stable dividend will retain more of their value through this downtrend than other REITs that fail to do this.

At least, this is how it should work on paper, but as we’ve seen with Filinvest REIT [FILRT 5.74 0.70%], the market doesn’t always respond as we would normally predict to a sudden and unexplained 50% drop in quarterly dividend.

Likewise, with Citigroup Energy REIT [CREIT 2.23 1.36%], which isn’t vulnerable to the POGO “sword of Damocles” on Metro Manila commercial lease rates, the market doesn’t always appreciate the strength of that income stream as we would normally predict.

Are these REIT market inefficiencies that could be exploited? I don’t know. Is it a good time to buy REITs, or to sell REITs if you own them?

In either case, your decision to buy or sell is based on your own investment goals that I can’t know.

What works for me might not work for you.

All I know is that in the short term, REITs aren’t expected to “shine”, and that the pressure on prices is likely to remain until there’s some sustained light at the end of the inflation tunnel.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest