US Federal Reserve rate decision is tomorrow

The US Federal Reserve’s Federal Open Market Committee (FOMC) will announce its decision on interest rates after the conclusion of its meeting on Wednesday morning in the US, in the early hours of Thursday before the PSE’s open here in the Philippines. I know quite a few traders who have developed “Fed Fatigue” and no longer pay attention to these announcements, but there is a lot going on that makes this one particularly interesting to watch. Here’s the context:

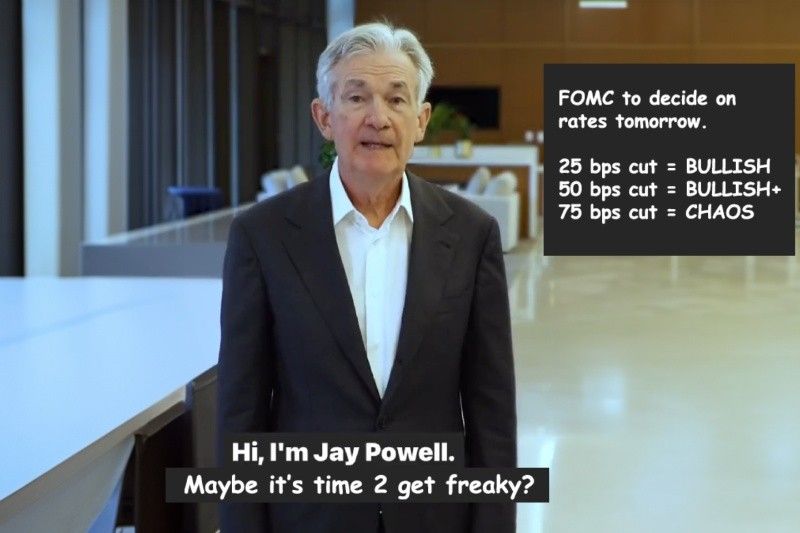

> The “pivot”: This is widely anticipated to be the Fed’s first rate cut since the start of the inflation crisis, marking the Fed’s “pivot” from an overall regime of monetary tightening (rising rates to suppress demand) to one of monetary easing (lowering rates to encourage demand). The general trading public appears to have priced a 25 basis point (bp) cut into the market, meaning that anything less than that could generate a significant negative response from traders, and anything more could provoke a more exuberant positive response. What will actually happen in response to the decision is hard to predict as the mix of emotions and expectations can produce some unexpected results. Particularly at important milestones, like the first rate cut, or at crucial societal times, like say at the eve of a massive election.

> Last move before election: This is the Fed’s last meeting before the US votes on its next President in November. Rising stock markets are often perceived as positive for incumbent presidential candidates, but here the incumbent (Joe Biden) has rejected the opportunity to run for a second term. Will his Vice President, Kamala Harris, benefit from the market’s success to the same degree as the incumbent? Will a negative reaction to the Fed’s decision tarnish her image heading into the vote? Will a positive reaction help?

> USD / PHP: Generally, lower rates weaken a country’s currency, so we would expect the value of the US Dollar to suffer due to any rate cut, let alone one that might be 50 bps or even 75 bps. Any cut would increase the interest rate differential between the BSP and the Fed and likely help the value of the Philippine Peso relative to the US Dollar, with bigger cuts leading to bigger differentials and bigger potential boosts to the Peso. I think the Fed doesn’t consider us when they make their decisions, so there’s always the chance for the BSP to be caught a little flat-footed by what the Fed does tomorrow morning.

> Where do we go from here? While the Fed isn’t watching the BSP that closely, you can bet the BSP has its multi-monitor setup tuned to the announcement and the subsequent reaction and the analysis of both. Groups here have made similar calls to the BSP to quicken the pace of cuts, and I get the impression that a shock cut by the Fed could give the BSP the cover it needs to make a more significant move on rates.

MB BOTTOM-LINE: The Peso has flexed some recent strength so it will be very interesting to see how the currency markets react to what the Fed does tomorrow. Well, to be honest, it’s going to be a little bit of “Must See TV” for me to watch the reactions across all of the markets tomorrow. Chances are best that the Fed does the boring thing and pivots with the minimum ante of a 25 bp cut, but if they don’t call that play, then we could be in for some spicy fluctuations that could shake loose some intriguing analysis. To me, the US Fed and the BSP are like two dogs that are leashed to one another, running loose in a wide-open field of opportunities and dangers. Of course, the US Fed is the larger more influential dog on the leash, and if it suddenly darts hard to the left (lower rates), then the BSP is going to feel that and we’re going to have to deal with that pull regardless of the direction that we’re running in and where we want to go.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest