Quick Take: CNPF's tease and 4 more market updates

Axelum [AXLM 2.62 4.4%; 57% avgVol] [link] wants to modify its articles of incorporation to convert 200 million of its authorized capital shares into redeemable preferred shares. The new class of preferred shares will have the same par value as the common shares. If approved by shareholders, AXLM would have P5 billion in authorized capital stock, split between P4.8 billion in common shares (P1 par value) and P0.2 billion in preferred shares (P1 par value). AXLM has 4 billion outstanding common shares.

MB Quick Take: Selling these new prefs would give AXLM an injection of capital without taking on additional debt from banks. It would also give AXLM the flexibility to be able to pay-off the entirety of the “debt” at the sole discretion of the AXLM board. It’s a nicer, softer form of debt.

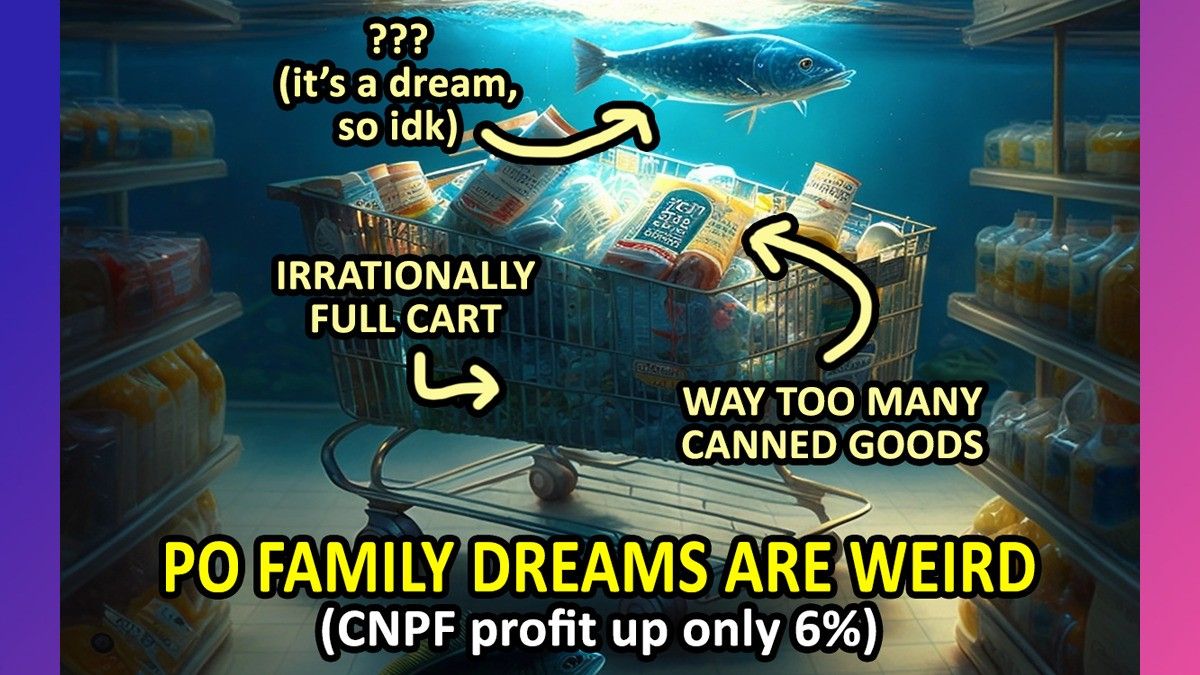

Century Pacific [CNPF 24.50 1.8%; 43% avgVol] [link] teased FY22 net income of P5 billion, up 6% y/y, on P62.2 billion in consolidated revenues, up 16% y/y. CNPF said that, “despite market challenges”, its FY22 results were driven by the “outperformance” of its Branded foods segment (Marine, Meat, Milk, and other emerging businesses) which grew 16%.

MB Quick Take: I’m going to wait for the full segmented data, because there’s a lot to like about CNPF, but there’s also a lot of questions that investors could raise about perhaps this growth phase losing steam. It’s healthy for CNPF to post a 16% increase in revenue, but it earned mid single-digit net income off that revenue bump for the lowest net income increase since CNPF joined the PSE back in 2014. Profit was up 23% in 2020, up 20% in 2021, and now up just 6% in 2022. The pandemic years were undoubtedly great for CNPF as we were forced to eat at home and lower our culinary expectations, but will those choices be “sticky”? Are we getting tired of being at home, just eating sardines and other non-perishables?

Emperador [EMI 20.95 0.2%; 41% avgVol] [link] declared a P0.29/share dividend, payable on May 25 to stockholders of record on May 2. Relative to EMI’s closing price from the day before the announcement, the dividend’s yield is approximately 1.39%. As EMI notes, this is the first dividend that it has declared since it completed its secondary listing on the Singapore Stock Exchange and changed its ticker to “EMI”.

MB Quick Take: EMI has an erratic dividend history. It paid one dividend per year from 2014 through 2020, then declared three dividends in 2021, then nothing in 2022. But then again, people don’t really own EMI for its divs; the stock proved itself as a pandemic darling, and is up 180% since the month before the COVID lockdowns began.

Apex Mining [APX 2.20 3.8%; 196% avgVol] [link] said that it earned P3.3 billion in consolidated net income in FY22, up 408% from the P0.7 billion it earned in FY21. Consolidated revenues were P10.3 billion, up 39%. APX said that this was an all-time high net income for the company. It mined 28% more gold and 6% more silver than the previous year. The price for gold was up 1%, while silver was down 11%.

MB Quick Take: This is truly the Ricky Razon Era. Since capitalizing on the smash-and-grab politics of Duterte to seize control of Manila Water [MWC 19.34 1.4%; 32% avgVol] in 2021, Mr. Razon has been something of an unstoppable force, seemingly with fingers in every pie worth eating. It helps to have been cashed-up right around the time Dennis Uy (predictably) ran his mini-empire aground on the debt rocks off the coast of Regime Change Island. It’s easy to think that they’re two titans cut from the same cloth who are just headed in opposite directions, but that comparison would be at once too kind to Mr. Uy and insulting to Mr. Razon, who seems able to effectively manage his growing collection of profitable companies with (so far) a superior blend of acquisitions, operations, and risk management.

Del Monte Pacific [DELM 12.40 11.7%; 424% avgVol] [link] disclosed that it plans to conduct a US-based initial public offering of the parent company of its American subsidiary, Del Monte Foods, Inc (DMFI). DELM said that DMFI will submit a “confidential” draft registration with the SEC in the US, but that no other aspects of the proposed offering are known yet at this time.

MB Quick Take: DELM has been talking about this (or something like it) since 2021. They’ve been thirsty to list something, whether it was the PH subsidiary or the US subsidiary, and it felt like it was only a matter of time before something was done to unlock some of that value for shareholders in a liquidity event. But this group is flighty; the old Market Conditions Monster has killed IPO plans in the past couple of years, and might do so again this year. I’ll believe it when I see it, but investors liked the news. The stock was up more than 10% in intraday trading.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest