COL Financial has “another record year” thanks to uptick in retail investor participation

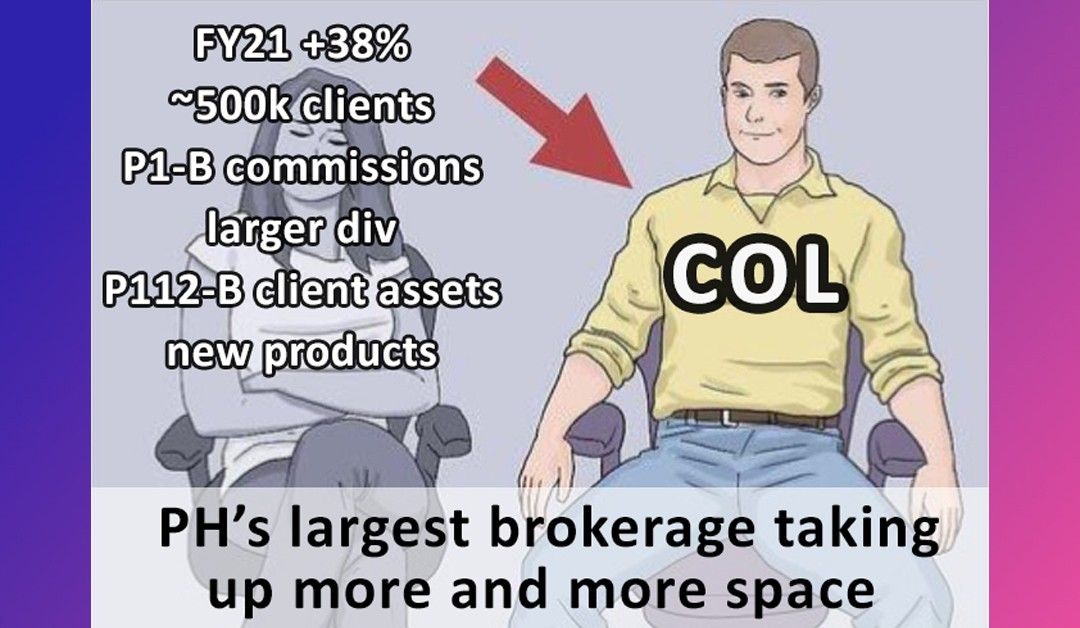

The country’s top discount brokerage, COL Financial [COL 3.62 1.63%] [link], issued a press release to tease what it calls “another record year” with a 38% increase in FY21 net income to P582 million. COL reported P1.3 billion in revenues, dominated by P1.0 billion in commission revenues.

COL said that it had “almost half a million” investors in its client base at the end of 2021, which it claimed to represent a “record market share” of 8.6%. New clients mean new assets. COL reported a record high P112 billion in client assets on P6.7 billion in net new inflows.

MB BOTTOM-LINE

COL’s strategy of targeting the retail investor demographic has caused its customer base and its client assets to explode.

This growth has been great for COL’s bottom-line, but it has also caused COL (and its users) some painful infrastructure headaches, especially during the basurapalooza when penny stocks were on fire.

Those website issues seem to be a thing of the past, but we can’t be sure that COL has made the necessary changes until the website and its infrastructure is subjected to a similar spike in usage and trade volume, and the last year of trading has been quite anemic compared to those crazy early days of 2021.

Back to the financials, COL makes money off our deposits (interest income) and our trades (commission income).

You know how your cash doesn’t make any interest while it’s just sitting in your broker account waiting to be invested?

Yeah, well, COL isn’t just sitting around waiting for you to make up your mind; they’re depositing your cash with banks to earn interest income. In the “old days”, interest income used to be a much larger percentage of COL’s revenues.

Now, the overwhelming majority appears to come from commission revenues. That’s the money that COL makes every time you place a trade.

Given the trends that I’ve seen from the interest in Merkado Barkada, I don’t think the rising retail interest in the market is going away anytime soon.

This bodes well for COL’s profitability going forward, as COL hopes to capture an out-sized portion of those new investors on its platform, and re-deposit their cash in short-term savings products that will (hopefully for COL shareholders) earn higher returns as interest rates rise in the second half of the year.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest