Synergy Grid sets FOO listing on November 12

Synergy Grid [SGP 395.80], the backdoor shell for the transmission grid monopoly submitted an updated prospectus for its follow-on offering (FOO) of 1,053,500,000 common shares (plus 101 million common shares for an over-allotment option) at between P15.00 and P25.00 per share.

The over-allotment option shares are being sold by Henry Sy Jr. and Robert Coyiuto Jr., so any money raised through this sale will not benefit SGP but will instead go directly to those selling shareholders.

The rest of the money raised will go to SGP, which will use the money to purchase non-voting shares in NGCP within 12 months of the FOO. The non-voting shares will be issued by National Grid Corporation of the Philippines (NGCP) to SGP (not purchased from Mr. Sy or Mr. Coyiuto), so the purchase price paid by SGP will go to NGCP, and NGCP has said that it will use the proceeds for its heft capex requirements for the 2021-2025 period.

This FOO is primarily to raise SGP’s public ownership level up above the 20% minimum threshold, which was violated in May when the share-swap between Mr. Sy, Mr. Coyiuto, and SGP resulted in SGP’s public ownership level falling below 1%. According to the data provided in the prospectus, NGCP has declared P51.0 billion in dividends to its owners since the start of 2018.

MB BOTTOM-LINE

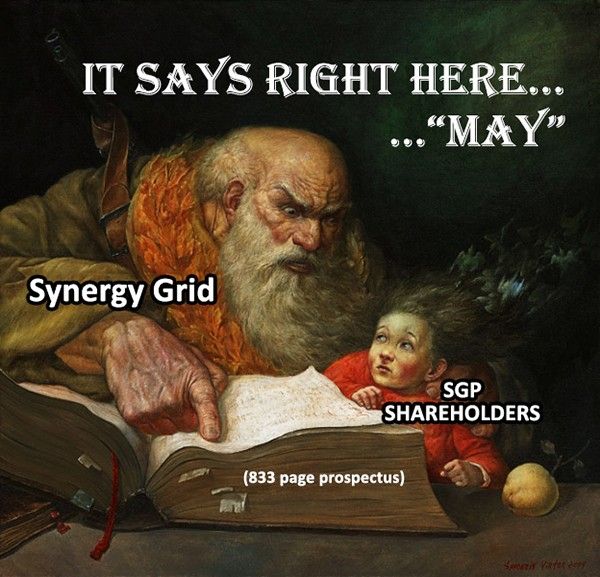

The dividends section of the prospectus says that SGP “may” declare dividends of 100% of its previous year’s net income and that OneTaipan, Monte Oro, Pacifica21, and Calaca (the various corporate layers owned by Mr. Sy and Mr. Coyiuto, which are now owned by SGP) all adopted “similar” dividend provisions where “shareholders are entitled to up to 100% of the prior year’s net income”.

The devil is in the details, and the weasel words used in these statements hint at some of the places the devil could be hiding. SGP “may” declare dividends of 100%... but it also may not. Shareholders of OneTaipan, Monte Oro, Pacifica21, and Calada are "entitled up to” 100% of the prior year’s net income, but that’s not the same thing as saying that they’re “entitled to" 100%.

Let’s take a closer look at the dividend information that SGP provided. It said that NGCP declared P51.0 billion in dividends to China, Monte Oro, and Calaca, since 2018. If we take out China’s 40%, that leaves P30.6 billion shared equally between Monte Oro (owned by OneTaipan) and Calaca (owned by Pacifica21). If we follow the dividends that were declared out of OneTaipan and Pacifica21 to Mr. Sy and Mr. Coyiuto, we see that only P27.77 billion made it out of OneTaipan/Pacifica21 as dividends to shareholders of the P30.6 billion that went into Monte Oro/Calaca originally from NGCP.

The two intermediary layers caused some P2.83 billion to “leak” out of the system. That’s 9.2% of the dividends lost, and we aren’t told what that money went towards so we can’t determine if it was beneficial to NGCP or to the end shareholders. The other odd bit of this prospectus is the plan for SGP to subscribe to non-voting shares; while SGP will own shares directly in NGCP, the non-voting nature of those shares will effectively prevent the portion of NGCP which is publicly owned through SGP from having any say in the operation of NGCP.

Based on NGCP’s profitability and the dividends it's been declaring year after year, I can see why Mr. Sy and Mr. Coyiuto appear to have slow-walked the company to market and arranged the transaction in this way so as to retain as much control over the flow of dividends as possible.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest