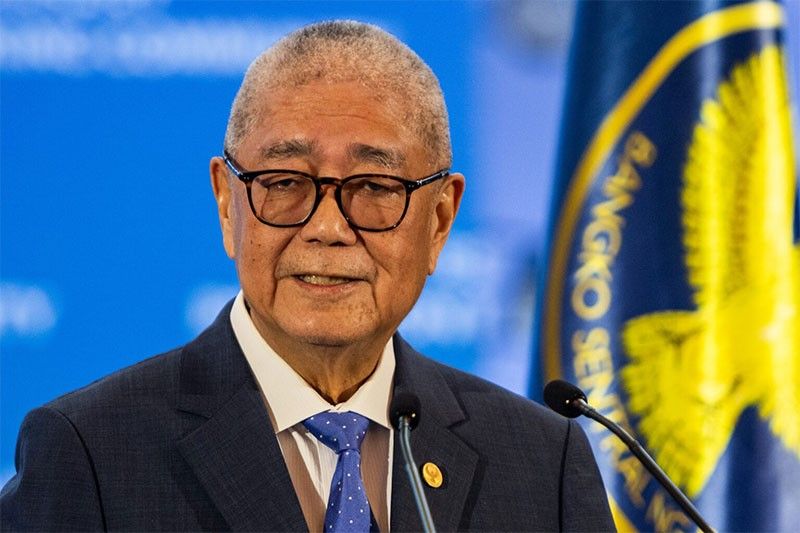

Remolona: Another rate cut possible

MACTAN, Cebu, Philippines — The Bangko Sentral ng Pilipinas (BSP) has signaled a possible interest rate cut in December, following the slower-than-expected economic growth in the third quarter and the within-target inflation print in October.

On the sidelines of the BSP-IMF Systemic Risk Dialogue in Cebu, BSP Governor Eli Remolona Jr. said that either a 25-basis-point rate cut or a pause is on the table at their final policy meeting this year on Dec. 19.

“We’re still in the easing cycle. Either we cut in December or we cut in the next meeting. But gradual cuts only, not (aggressive),” Remolona told reporters.

He also said a total of 100 basis points of rate cuts could be expected next year. “It’s not exact, it could be bigger or lower. But that’s in the ballpark.”

The BSP lowered its key interest rate by 25 basis points to six percent last Oct. 16, bringing its total rate cuts to 50 basis points since it started its easing cycle in August.

Prior to the cuts, the BSP kept borrowing costs steady for six straight meetings starting November 2023.

According to the BSP chief, the Monetary Board’s next policy move will largely depend on the inflation data in November, which is expected to still be within the two to four percent target range.

Headline inflation rose to 2.3 percent in October from 1.9 percent in September. Year to date, inflation averaged 3.3 percent, still within the BSP’s two to four percent target.

Remolona also said the third-quarter gross domestic product (GDP) data can be considered an “aberration” and economic activity could pick up in the fourth quarter amid the holiday season.

The Philippine economy grew by only 5.2 percent in the third quarter, slower than the 6.4 percent in the previous quarter and six percent a year ago. From January to September, GDP averaged 5.8 percent.

Meanwhile, Remolona said the central bank is intervening in the foreign exchange market, though only in small amounts, to manage sharp movements in the peso.

He said the BSP’s actions are not aimed at hitting specific targets for the exchange rate but are instead focused on preventing excessive volatility.

“We intervene a little bit just so (the peso) does not spike too much (against the dollar),” he said. “We don’t have a target. We’ve been in and out in small amounts.”

He is also not worried about the peso’s depreciation against the dollar as the local currency remains below the 59 to $1 level.

“We worry more about the pass through effect. But for now, we’re still okay,” he said.

“If it depreciates very sharply, then we step in. If it’s not sharp, it doesn’t become inflationary,” he said. “It’s inflationary if it’s sharp and sustained. We only monitor the swings that take place over a few months.”

Remolona also acknowledged that market expectations, influenced by news events, play a role in peso fluctuations.

The peso has faced increased pressure in recent months, remaining above the 58 to $1 level since October, due to global economic uncertainties and the continued strength of the dollar.

- Latest

- Trending