Lower income tax bill filed in House

MANILA, Philippines - The push for lower individual and corporate income tax rates is gaining ground not only in the Senate but in the House of Representatives as well.

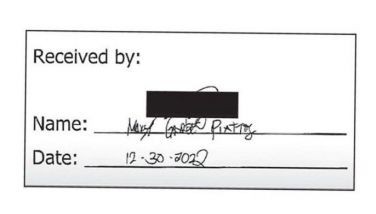

Valenzuela City Rep. Magtanggol Gunigundo I filed yesterday his version of the lower income tax bill, which is a counterpart of a similar measure introduced in the Senate by the chamber’s ways and means committee chairman, Sen. Juan Edgardo Angara.

Gunigundo told a news conference that his proposal would exempt workers earning up to P180,000 a year from taxation.

“The measure, Bill 4099, will add more than 2.4 million families to individual taxpayers who are exempted from income tax. At present, the law exempts minimum wage earners from paying any income tax,†he said.

He said these additional tax-exempt individuals would include government personnel with Salary Grade 8 like policemen with Police Officer 1 rank (P14,834 basic pay), soldiers with the rank of Private (basic pay is also P14,834) and many public school teachers.

“The reduction in income tax rates will stimulate the economy by providing individual taxpayers more disposable income, which they can either save or spend in the engagement of services or purchase of goods that are subject to the 12-percent value-added tax (VAT),†he said.

He said since people tend to spend their disposable income, there “would be increased demand for services and goods, and businesses would have to cope up with this by hiring more workers to increase production.â€

“Corporate taxpayers, on the other hand, can use their additional disposable income by giving out more dividends, which shareholders may use similarly in the purchase of goods and services. They can also invest it in modern equipment, infrastructure, facilities upgrade, and research and development,†he added.

Gunigundo conceded that his proposal would result in a P90-billion revenue loss for the government.

“But the initial revenue drop should not deter Congress from reducing income tax rates. The bigger picture, which is the Philippine economy, will in the long run gain much more in terms of lower unemployment, more VAT collections, a happier people and more productivity,†he said.

He said the Department of Finance and the Bureau of Internal Revenue would treat his projected P90-billion drop in collections as a loss on the part of the government.

“I would rather look at it as a P90-billion gain for taxpayers. It is additional disposable income of P90 billion for taxpayers, especially salaried workers,†he said.

He added that if taxpayers spend that additional income for goods and services, the government would be able to recoup P10.8 billion in more VAT collections.

He pointed out that a simple corporate income tax structure would entice “those in the informal economy, which account for 40 percent to 45 percent of our gross domestic product, to enter the tax net and pay income tax, instead of constantly hiding from the BIR and falling victim to corrupt tax collectors.â€

Gunigundo’s proposal would reduce individual income tax rates from the current 32 percent to 30 percent. For corporate taxpayers, he is proposing a flat tax of 15 percent based on gross income.

He said the flat rate is a simpler scheme and would eliminate loopholes and discretion on the part of taxpayers and tax collectors.

- Latest

- Trending