New BSP chief vows stable financial system

MANILA, Philippines - Barely a year in office, President Duterte made his most important appointment when he named a career central banker, an insider, as the successor of former Bangko Sentral ng Pilipinas governor Amando Tetangco Jr.

Last May, Malacañang announced the appointment of then BSP Deputy Governor Nestor Espenilla Jr. as Tetangco’s successor and the fourth governor of the BSP.

Duterte’s most trusted lieutenant – Finance Secretary Carlos Dominguez – likened the search for the next BSP governor to the award winning American fantasy drama series “Game of Thrones.”

Together with three members of the Monetary Board, Dominguez said the hunt for the new BSP chief was like the “Game of Thrones” that is centered on the plot of the death match as dynasties attempt to reclaim the throne. “Its like the Game of Thrones,” he quipped.

Tetangco, who has been named among the world’s top central bankers, steered and helped the Philippines survive the Asian financial crisis in 1997 and the global financial crisis in 2008.

The economy grew 6.4 percent in the first quarter, slower than the 6.6 percent growth in the fourth quarter of last year due to weak private consumption. The GDP expanded seven percent in the third quarter of last year.

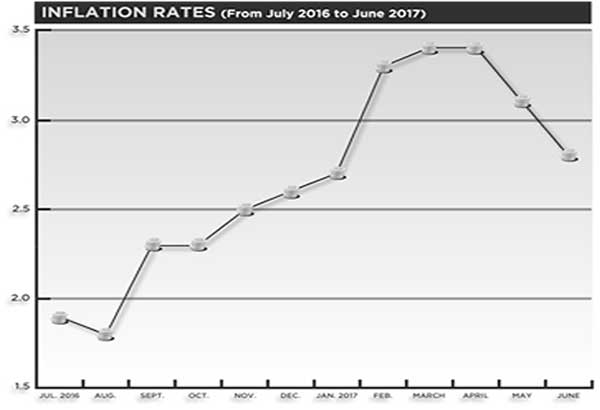

Inflation also remained manageable despite picking up to 3.1 percent in the first half due to rising food and oil prices. The plunge in oil prices pulled down inflation to 1.4 percent in 2015 and 1.8 percent in 2016.

The BSP has set an inflation target of two to four percent for 2017.

The robust domestic demand and benign inflation environment has allowed the BSP to keep an accommodative policy stance, keeping interest rates steady since September 2014.

The Philippines was also able to boost its foreign exchange reserves with the latest gross international reserves (GIR) level reaching $81.41 billion in end-June, adequate enough to cover 8.7 months’ worth of imports of goods and payments of services.

The buffer serves as shield against external shocks amid the volatile global financial markets due to the series of interest rate hikes implemented by the US Federal Reserve, the decision of the United Kingdom to leave the European Union or Brexit, the diplomatic crisis in the Middle East involving Qatar, among others.

Investment grade ratings reaffirmed

The investment grade ratings of the Philippines from S&P Global Ratings, Moody’s Investor Service, and Fitch Ratings have been retained under the Duterte administration.

The rating agencies uniformly acknowledged the BSP as one of the institutional pillars that generates positive marks for the Philippines.

S&P reaffirmed the country’s rating at ‘BBB’ equivalent to a notch above investment rating on a stable outlook. Moody’s and Fitch also reaffirmed the country’s credit ratings on the Philippines.

The Philippines credit rating of ‘Baa2’ with Moody’s is a notch above investment grade with a stable outlook while Fitch’s ‘BBB-‘ rating is equivalent to minimum investment grade rating with a positive outook.

An investment grade rating means lower costs for government, thereby freeing more funds for social services, infrastructure and other long-term investments for economic development. It also means cheaper sources of funds for both government and corporate borrowers.

New team and continuity

To complete the BSP’s seven-man Monetary Board, Malacañang has reappointed former Socioeconomic Planning secretary Felipe Medalla, former Trade secretary Peter Favila, and banker Antonio Abacan Jr of Metropolitan Bank & Trust Co.

Espenilla is also backed by deputy governors Diwa Guinigundo, Ma. Almasara Cyd Tuaño-Amador, and Chuchi Fonacier.

Espenilla vowed to continue the voyage of excellence to a bright tomorrow after his predecessor helped the country sail the rough seas and kept the economy and financial system on an even keel.

The new BSP chief has laid down his continuity agenda to ensure that both the economy and the financial system would remain strong, stable and resilient.

These include fine-tuning of monetary policy to make it more market-oriented, improving governance and risk management practices of banks, advocating for the timely enactment of vital pieces of legislation, and pursuing financial inclusion.

- Latest

- Trending