Bear bounce

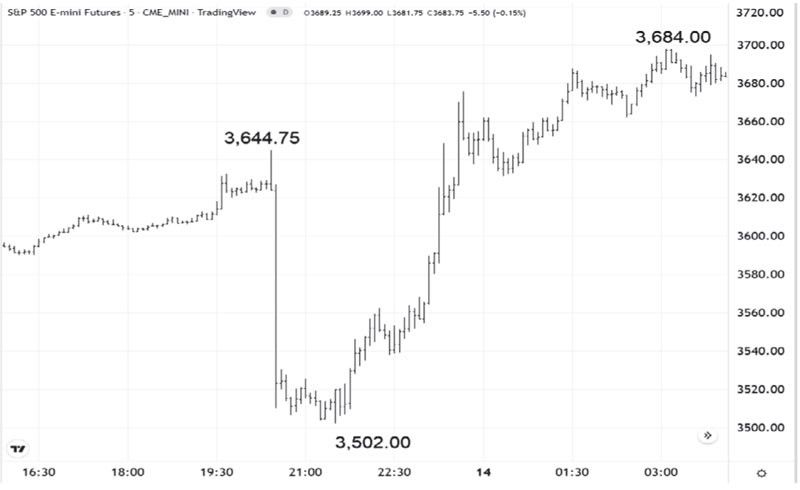

It was a wild trading session last Thursday. US CPI came in higher than expectations on the top line and core figures – the worst-case scenario. During pre-market hours, the S&P futures plunged four percent from a high of 3,644.75 pre-market to a low of 3,502 when the market opened. But by mid-day, it had completely reversed course and finished into one of the best days of the year. The S&P futures ended at 3,684, which means it moved a total of 324.75 pts or roughly nine percent round-trip. The S&P 500 closed 2.6 percent higher for the day, while the Dow and the Nasdaq Composite were up 2.83 percent and 2.35 percent, respectively.

Volatility cuts both ways

Bear markets are challenging to navigate because volatility cuts both ways. It increases the risks for both the bulls and the bears. One can be right in the direction of the trend, but if everyone is positioned the same way, a simple repositioning can send stocks moving dramatically in the opposite direction. Such is what happened last Thursday. Many investors were already super bearish ahead of the CPI print and were positioned accordingly. Hence when the stock market gapped down on the CPI news, short positions were immediately covered, and “put option” hedges were sold as investors booked profits.

Reversal or trap bait?

The major indices staged positive reversals last Thursday after initially gapping down in reaction to the worst-than-expected CPI report. Technical levels also factored in Thursday’s turnaround. The S&P 500 index bounced precisely at the 50 percent retracement of its March 2020 to January 2021 post-pandemic rally. The real test is what happens when prices reach the 20-day moving average, which has rejected prices lately.

Euphoria turns to panic

In bear markets, the days following quick, strong gains are most perilous and can often lead to an immediate blow-up, as the markets experienced in March 2020. Investors chasing Thursday’s strength panicked after realizing it was another false rally attempt. Hence, the market was sold off aggressively last Friday, with the S&P 500 falling 3.5 percent and the Nasdaq Composite declining by four percent from their intraday highs. Former market darling TSLA was down 9.5 percent from early morning prices.

No sign of capitulation

The VIX, or the so-called Fear Index, has not shown any sign of capitulation typically found at bear market bottoms. Since many investors were bearishly positioned ahead of the CPI report, the VIX was only 34 last Thursday. This is nowhere near as high as the VIX high of 85.47 during the 2020 bear market bottom and the 96.40 reading in October 2008 post-Lehman Brothers’ collapse.

Dollar surges anew

The US dollar surged anew as the Japanese yen tumbled to 148.73 last Friday, its lowest in 32 years. The Chinese yuan offshore likewise weakened to 7.216 against the dollar, its weakest close since February 2008. In today’s environment, a surging dollar is negative for global risk assets, which means that cash in US dollars is still the best place to be.

Opportunities abound

As difficult as last week’s bear market action is, it is important to remember that the best buying opportunities do emerge from such environments. It is especially during these volatile times that investors should look at the long-term horizon. Investors need patience and steadfast discipline, lots of it.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending