Different bears

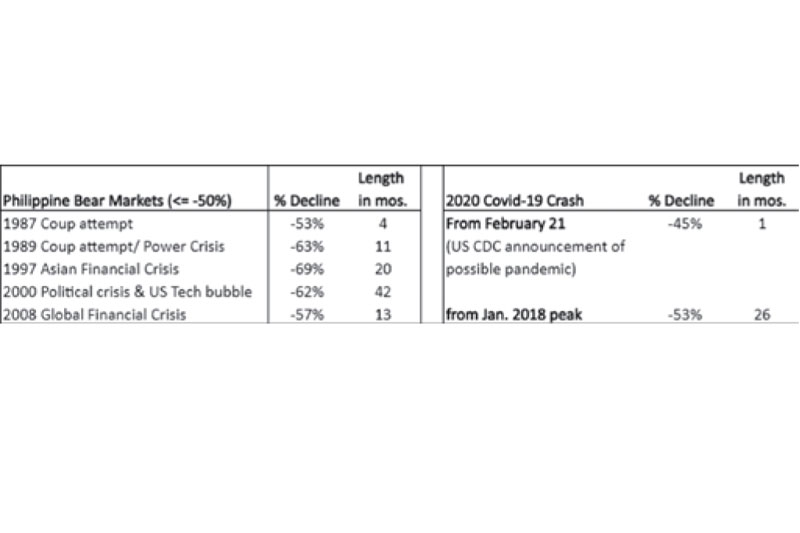

The extreme volatility and deep losses that Philippine stocks experienced last month are unprecedented. This bear market stands out as the fiercest not only in terms of monetary losses, but also from loss of life. This 2020 stock market crash clearly marked the end of the 11-year bull market and the start of this vicious bear. In line with this, we hope to learn from previous bear markets. We’ll review 1987, 1989, 1997, 1999, 2008, and the current 2020 market crash. We started with the 1987 bear because the market was moribund for many years before the 1986 EDSA revolution.

August 1987 coup — From 1986 to 1987, there were six coup plots to overthrow former president Corazon Aquino. The deadliest was the August 1987 coup attempt, which left 53 dead. It was during this period that the PSEi plunged 53 percent from the peak recorded the previous month. It took four months before the market’s eventual bottom. Before this decline, the PSE Index has risen eight-fold from its February 1986 level following the People’s Power revolution.

December 1989 coup and power crisis — The mutineers attempted to overthrow the Aquino government again in December 1989 by bombing the presidential palace and seizing air force headquarters and two broadcast stations. That instability triggered the start of a 63 percent decline in the PSE Index over the next 11 months. During that period, the Philippines also had a full-blown power crisis and rotating blackouts were frequent.

1997-98 Asian financial crisis - The devaluation of the Thai baht triggered the 1997 Asian financial crisis. The Philippine peso and other Asian currencies had similar devaluations. Asian economies with huge fiscal and trade deficits and high foreign debt-to-GDP ratios were exposed. During this period, the PSE Index declined 68.8 percent for 20 months before bottoming out.

2000 political crisis and US tech bubble — After a 150 percent rally in 1999, the Philippine stock market suffered a severe downturn due to a political crisis and the bursting of the US tech bubble. The rise of terrorism and geopolitical conflicts that led to the 9/11 WTC bombing, 2001 US-Afganistan, and 2003 US-Iraq wars prolonged the bear market. The market finally bottomed in 2003 after falling 62 percent over three and a half years.

2008 global financial crisis - The global financial crisis of 2008 started with the US subprime mortgage crisis and expanded to a credit crisis with the failure of Lehman Brothers in September 2008. The PSE index crashed 57 percent over 13 months, bottoming out in October 2008. It retested that level in March 2009, coinciding with the final lows of the US stock market.

2020 COVID — 19 crash — The 2020 market crash was sparked by the COVID-19 pandemic which has infected more than 1,100,000 people worldwide and has left more than 60,000 people dead as of Saturday morning. With no signs of slowing down worldwide, daily new cases are now growing at the rate of 80,000 per day.

PSE index crashes 45% in just one month

The speed and the volatility of the decline are what sets this current bear market apart. The PSE index suffered losses of as much as 45 percent in less than a month. This period is from Feb. 21 (date when the US CDC announced a possible pandemic) to March 19 when the PSE reopened after suspending its operations for two days. Note that the PSE Index hit an eight-year intraday low of 4,039 on that day. It has since rebounded 32 percent to close at 5,346 last Friday.

Has the market bottomed? Is it time to buy?

Based on technical analysis, most bear markets often have three down legs. So far, the current bear market only had two. Usually, a retest of lows is needed to shake all the sellers out before the market turns for a new uptrend. The market may need to consolidate much longer below 6,500.

All bear markets, no matter how painful and how harrowing the experience, eventually end. The outcome, length and the magnitude of this current bear market will ultimately depend on government actions and resolve (through lockdowns, extensive testing, and contact tracing), and people’s cooperation (through social distancing and staying home). Ultimately, the bottoming out process will depend on how soon the world can flatten the curve and contain this pandemic.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending