When good turns bad

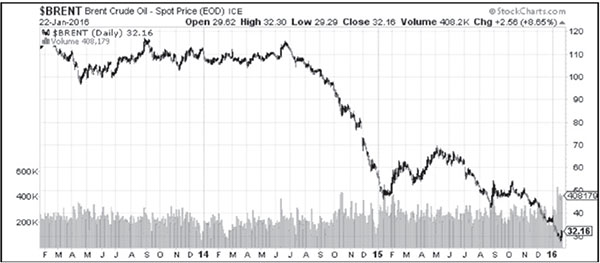

When oil prices started coming down, everyone thought many countries would benefit from low oil prices. Since our economy is consumption driven, the Philippines was identified as one of the main beneficiaries of a low oil price regime. While it was generally expected oil prices would fall, many, including us, were shocked at the speed and magnitude of the drop. Moreover, what has perplexed many investors is how the drop in oil prices, which was viewed as beneficial for many countries such as ours, is now perceived as something bad for the stock market.

Why the drop in oil is causing market turmoil

Stock markets have been battered so far this year because many savvy investors have discerned the sharp drop in oil prices is reflective of the following:

1. Slowing global economy. Last week, the IMF downgraded global growth to 3.4 percent from 3.6 percent. The drop in oil prices is a signal of the weakening demand for oil and a slowdown in global growth. There are some hedge fund managers, including Ray Dalio of Bridgewater, and George Soros, who stated the savage drop in oil prices is a sign of a potential recession or even depression.

2. Weakening demand from China. The weakening demand for oil is a sign of the pronounced slowdown in China which accounts for about 30 percent of global growth. There is a concern the precipitous drop in oil prices is signaling a hard-landing in China.

3. Deteriorating credit outlook and possible defaults for oil producing companies. Many oil producing companies will be affected by the current environment. The recent move has put oil prices below the breakeven price of many oil producers, especially the shale oil producers in US and the sand oil producers from Canada. Consequently, default risk among oil producers is rising as oil stays lower for longer. Last week, debt-watcher Moody’s said it would review its ratings for 120 energy companies around the world in light of the weak outlook for oil prices.

4. Sharp currency depreciation among commodity and oil producing countries. The drop in oil has resulted in the sharp depreciation of the currencies of commodity producers and oil exporters, including almost all EM countries. This may result in more strain in their respective economies and sharper drops in their stock markets.

5. Worsening credit outlook for countries. Oil and commodity producing countries are also affected by low oil prices. Note current prices are significantly below the fiscal breakeven of major oil producing countries. This means governments there are running budget deficits. Aside from this, persistently low oil prices will result in worsening economic conditions which may exacerbate rising geopolitical tensions. Given the deterioration in their credit outlook, these countries are now also on the watch list of credit agencies and investors.

6. Slower OFW remittances. As of end-2013, there were more than one million OFWs in Saudi Arabia. Deteriorating economic conditions, coupled with the rising geopolitical tensions within the region, will affect the employment prospects of OFWs in the Middle East. This will, therefore, impact OFW remittances which have started to slow down last year.

Drowning in oversupply

In our article last week (It’s the Strong Dollar, Stupid! – Episode 3, Jan. 18), we wrote about the historic 75 percent drop of oil in less than two years. Oil prices actually dropped to $27 before recovering late last week.

Source: Stockcharts.com

The drop in oil prices is mainly due to changes in supply and demand. The increased production of US shale oil producers in the past few years has dramatically increased the supply of crude oil. OPEC has responded to this phenomenon by making a determined effort to defend market share instead of cutting its output and defending the price.

Table 1 – Supply and consumption of oil; top 10 producers of oil

Petroleum and other liquids; in millions of bpd

Source: US Energy Information Administration

The recent lifting of sanctions on Iran means additional supply will come in and further exacerbate the supply situation. Meanwhile, demand for oil has slowed down in light of slowing growth. The slowdown in China, which accounts for about 30 percent of global growth, therefore raises serious concern the demand for oil may continue to slow in the coming years. According to the International Energy Agency (IEA), “unless something changes, the oil market could drown in oversupply.”

The good and the bad for the Philippines

On the one hand, the Philippines has benefited from lower oil prices, as imports of petroleum crude declined to $3.35b (down 37.6 percent YoY) for the first 10 months of 2015. However, not all the benefits of low oil prices are passed on to consumers. There are many other costs involved in converting crude oil to gasoline, such as storage, refining, taxes and labor. Even the peso’s depreciation against the dollar has partially offset the gains from lower oil prices. On the other hand, the sharp drop in oil prices has contributed to the tense political and economic environment in Saudi Arabia and other MENA countries. This directly affects the employment prospects of OFWs in the MENA region. Note that last year, for the period from January to November, 23 percent of total OFW remittances came from the Middle East, with 11 percent coming from Saudi Arabia alone.

Lower for longer

Given the current situation, many expect oil prices to stay lower for longer. Thus, the growing concern is how a prolonged low oil price regime will affect the liquidity and solvency of many corporates and sovereigns. In previous crises, property companies took center stage when credit concerns erupted. Now, there are warnings another debt crisis is looming among commodity and oil producers.

Reminiscent of 1997 or 2008?

This year, we have seen historic drops in many stock indices, EM currencies, and high-yield bonds. Is this the 1997 Asian financial crisis or the 2008 subprime crisis all over again? Is this the beginning of another major crisis? Given the current situation, hedge funds are pouncing on corporates with weakening credit outlook and are attacking vulnerable countries. The wild swings across many asset classes and scenarios of a possible devastating crisis have caused many central banks, economists and investors to anxiously monitor what is happening globally.

Central banks to the rescue

Towards the end of last week, global markets got a welcome respite as major central banks jointly pledged to maintain policy support for their respective economies. Moreover, global central bankers suggested more policy stimulus will be on the way, if necessary. ECB president Mario Draghi said, “We have plenty of instruments. We have the determination, and the willingness and the capacity of the Governing Council, to act and deploy these instruments.” Likewise, BOJ Governor Haruhiko Kuroda said, “If necessary to achieve the two percent inflation target, particularly if the underlying inflation trend is seriously affected, then we can expand or further strengthen QQE in many ways.” Even China has pledged to maintain its own stimulus program. These statements have so far caused markets and oil prices to rebound sharply late last week. The Fed will have its FOMC meeting this week and the markets will definitely wait for their guidance and assessment. Moving forward, it will be important to monitor whether the coordinated language and stimulus actions of central banks will be enough to restore confidence in the markets and stabilize global growth prospects.

Philequity investor briefing

We invite our investors to Philequity’s annual investor briefing on Saturday, Jan. 30, at the Meralco Theater. Registration will start at 8am and the briefing will start at 9am. Please register ahead of time at events@philequity.net or call our office if you wish to attend.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email ask@philequity.net.

- Latest

- Trending