The gift that grows

Last Monday, June 9, 2014, we held the annual stockholders’ meeting and investor briefing for the Philequity Dividend Yield Fund. As with our usual presentations, our directors, fund manager and analysts shared their views and outlook. Our oldest and wisest director, Mr. Washington Sycip, also shared his thoughts with our investors. Through this article, we want to share some of the questions that were asked and discussed during the briefing.

1. What is the difference between Philequity Fund, Philequity Dividend Yield Fund (PDYF) and other mutual funds?

What makes Philequity different from other funds is that it has the same fund managers since inception. Moreover, Philequity has the most experienced fund managers and the oldest board of directors among the mutual funds in the country. This level of experience and exposure has helped Philequity build its long-term track record of consistency and outperformance.

Philequity Fund’s mandate is to prudently manage investments in both good and bad market conditions while trying to get the best returns. The fund has done this by employing a long-term investing strategy based on sound stock picking and opportunistic trading. As such, the fund has soundly outperformed the PSE Index over the past 20 years with a compounded annual return of 19 percent. Moreover, Philequity Fund’s 16.4-percent year-to-date return (YTD) has outperformed the 15.2-percent YTD return of the index.

PDYF has a similar mandate for long-term capital appreciation. However, PDYF has a particular focus on earning through dividends. Understandably, most dividend yield funds would focus on stocks with high dividend yields. What makes PDYF unique is that it also focuses on dividend growers, or companies that can consistently and significantly grow their dividends over time. PDYF’s 15.9-percent return since its inception on Feb. 7, 2014 has outperformed the 14.7- percent return of the PSE Index over the same period.

2. Why has our stock market slowed down?

Our index reached its recent peak of 6,909 in less than five months of trading. At the peak, our index was up 17.3 percent vs. last year’s close. Even as our index has paused, we are still up 15.2-percent YTD. This is still quite impressive considering that less than six months of 2014 have passed. Hence, we view this phase as a healthy breather in preparation for the next leg of the rally.

Aside from moving too fast and too soon, our stock market paused as GDP came in below forecast and inflation figures came in higher than expected. We deem these as temporary setbacks. We believe that the government and the BSP will do what is needed to stimulate strong economic growth while maintaining price stability. Although our stock market experienced some net foreign selling due to these setbacks, net foreign buying in the month of June has been strong and has so far amounted to P2.3 billion.

3. The market is now correcting. Should we wait to buy at lower levels? At what levels should we buy?

The timing, magnitude and duration of corrections or consolidations are extremely difficult to predict. What is more important than timing the market is asset allocation. If one has no equity investment or is underexposed to stocks, then it might be a good time to buy stocks slowly and gradually, depending on one’s risk appetite and asset allocation strategy. We have always said that everyone should have a certain portion of their investment portfolio in equities. Hence, one’s risk appetite and equity exposure should dictate how one should invest in times like this.

4. How deep will our stock market correct?

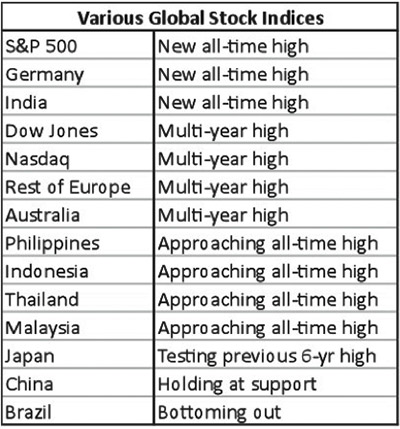

Though there are various risks and global headwinds, our stock market may not correct as much with an ongoing global bull run. As we showed in our presentation, many developed market (DM) indices are trading at or near all-time highs while others are hovering at multi-year highs. Similarly, ASEAN indices are approaching all-time highs. The table below summarizes this.

Sources: Bloomberg, Wealth Securities

Despite the strong move of various global indices, we note that the war in Iraq remains a risk. The escalating sectarian violence in Iraq has so far affected crude oil prices, and high oil prices are detrimental to global economic growth. This is why the war in Iraq has caused the stock market to correct in the past few days.

Thoughts and Insights from Mr. Washington Sycip

1. It was reported that one of the reasons why you invested in Philequity Fund is because of President Aquino. It was also reported that you are not worried about what will happen to our economy and the stock market in 2016 after President Aquino steps down.

Mr. Sycip: I added to my investments in Philequity Fund when President Aquino was elected in 2010. Back then, I thought that the country would immensely benefit from a trusted and honest leader. To date, my incremental investment in 2010 has more than doubled. I also agree with the analysis of S&P and our economic managers that our economy will continue to perform strongly in 2016 and beyond, notwithstanding a change in leadership. That is why I added to my investments in Philequity recently.

2. It was reported in a major daily that you watched Taylor Swift’s Manila concert and you asked Philequity’s fund manager, Mr. Wilson Sy, to accompany you. What made you want to watch this concert?

Mr Sycip: I am turning 93 years old by the end of the month but I am still very enthusiastic about learning. I wanted to understand the hysteria behind international pop acts like Taylor Swift and One Direction, so I went to the concert to see it first-hand. I also wanted to understand why young people are paying so much for a concert like this. Definitely, I will not spend that kind of money, though I find Taylor Swift very pretty. On top of all the excitement, what I saw was the increased spending power of Filipinos. Parents are also more indulgent now. They save money so that their kids can watch their favorite pop stars.

(We at Philequity find it amazing that at 92, Mr. Sycip still wants to learn, do research and understand new things.)

3. Just like Philequity’s Chairman (Mr. Ignacio Gimenez) and fund manager (Mr. Wilson Sy), you buy shares of Philequity Fund and give them as gifts to your househelps, drivers, godchildren and even to charitable institutions. Why do you do this?

Mr. Sycip: I make some donations to charity by giving them shares in Philequity Fund. I also buy shares and give them to my househelps and drivers. I give them Philequity Fund shares so that they would learn how to save and invest. Many of them are happily surprised at how much their investments have grown and how much money they are left with. I think that this is better than just giving them money. By giving Philequity Fund shares, I am able to teach them about investments while giving them a gift that grows over time.

For further stock market research and to view our previous articles, please visit our online trading platform at www.wealthsec.com or call 634-5038. Our archived articles can also be viewed at www.philequity.net.

- Latest

- Trending